Energy Development Corporation

With the recent announcement of a Voluntary Tender Offer for EDC Shareholders, price fluctuation below the tender offer price can potentially give an investor/trader a good gain in a relatively shorter period of time.

Tender Offer Details

- Tender Offer Price: P7.25 per share

- Offer Period: August 10 ~ September 18, 2017

- Closing/Cross/Settlement Date: September 29, 2017

Trading Plan

- Accumulate at below tender offer price with consideration of upside potential, sell to the market near offer price or higher.

- Participate in the tender offer if remaining position cannot be disposed off the market.

Sunday, August 6, 2017

Thursday, July 20, 2017

PSEi Chart Update

Philippines Stock Exchange PSEi Index

- PSEi has retested the resistance zone around 8000~8100.

- Immediate support area remains at 7720~7780.

- Previous Bull Flag breakout pattern remains valid with projected target price around 8300. See previous chart update for reference:

https://psetrends.blogspot.com/2017/04/psei-chart-update-and-technical-analysis.html

- PSEi has retested the resistance zone around 8000~8100.

- Immediate support area remains at 7720~7780.

- Previous Bull Flag breakout pattern remains valid with projected target price around 8300. See previous chart update for reference:

https://psetrends.blogspot.com/2017/04/psei-chart-update-and-technical-analysis.html

Wednesday, July 19, 2017

SMC price action analysis

San Miguel Corporation

SMC is recently trading near its immediate support area including the 19-month uptrend line.

Trading Plan

- Potential buy near support with a stop-loss a few points below immediate support area (keep at least 1:2 risk/reward ratio, the higher the better).

SMC is recently trading near its immediate support area including the 19-month uptrend line.

Trading Plan

- Potential buy near support with a stop-loss a few points below immediate support area (keep at least 1:2 risk/reward ratio, the higher the better).

Thursday, July 13, 2017

2GO breakdown

2GO Group, Inc.

2GO is on a breakdown from a Descending Triangle pattern with projected target price around 15.5~16.4.

See previous analysis for reference on this pattern as it unfolds:

https://psetrends.blogspot.com/2017/07/2go-potentially-forming-bearish-pattern.html

Trading Plan

- Avoid for now.

2GO is on a breakdown from a Descending Triangle pattern with projected target price around 15.5~16.4.

See previous analysis for reference on this pattern as it unfolds:

https://psetrends.blogspot.com/2017/07/2go-potentially-forming-bearish-pattern.html

Trading Plan

- Avoid for now.

Monday, July 10, 2017

EW Price Action Update

East West Banking Corporation

EW is forming a Bearish Engulfing candlestick pattern after the recent sharp rally. It's a potential sign of a stalling uptrend and may signal a possible pullback or consolidation to follow.

*In this condition, some traders who are after short term gains may choose to sell to protect the profit from recent advancement.

Trading Plan

- Avoid for now.

- If in a trade already, take some profit or scale down position. Profit run the rest of the position with trailing stop.

EW is forming a Bearish Engulfing candlestick pattern after the recent sharp rally. It's a potential sign of a stalling uptrend and may signal a possible pullback or consolidation to follow.

*In this condition, some traders who are after short term gains may choose to sell to protect the profit from recent advancement.

Trading Plan

- Avoid for now.

- If in a trade already, take some profit or scale down position. Profit run the rest of the position with trailing stop.

Tuesday, July 4, 2017

2GO potentially forming a bearish pattern

2GO Group, Inc.

2GO is potentially forming a Descending Triangle pattern which is normally considered as a bearish chart pattern that indicate distribution. It may also be considered as a reversal pattern at the end of the recent uptrend.

However, if the consolidation continues and the sideways price action goes beyond the triangle apex without significant breakout or breakdown, it will likely invalidate the pattern.

Trading Plan

- Avoid for now and observe the price action in the coming days.

2GO is potentially forming a Descending Triangle pattern which is normally considered as a bearish chart pattern that indicate distribution. It may also be considered as a reversal pattern at the end of the recent uptrend.

However, if the consolidation continues and the sideways price action goes beyond the triangle apex without significant breakout or breakdown, it will likely invalidate the pattern.

Trading Plan

- Avoid for now and observe the price action in the coming days.

Monday, July 3, 2017

TEL has hit Head-and-Shoulder Bottom TP

PLDT Inc.

TEL has hit the projected target price around 1930 from the previous Head and Shoulder Bottom breakout last March this year. See the previous analysis of this pattern as it unfolds:

https://psetrends.blogspot.com/2017/04/tel-breakout-update.html

In the shorter time frame, a Bullish Hammer candlestick pattern has formed up after the recent pullback, a potential trend reversal pattern (needs confirmation today).

Trading Plan

- If still trading the Head and Shoulder Bottom pattern (a medium term trading position), take profit on strength or scale down position.

- Otherwise, avoid for now.

TEL has hit the projected target price around 1930 from the previous Head and Shoulder Bottom breakout last March this year. See the previous analysis of this pattern as it unfolds:

https://psetrends.blogspot.com/2017/04/tel-breakout-update.html

In the shorter time frame, a Bullish Hammer candlestick pattern has formed up after the recent pullback, a potential trend reversal pattern (needs confirmation today).

Trading Plan

- If still trading the Head and Shoulder Bottom pattern (a medium term trading position), take profit on strength or scale down position.

- Otherwise, avoid for now.

Thursday, June 22, 2017

RWM harmonic pattern update and target hit

Travellers International Hotel Group, Inc.

RWM filled the previous gap at 3.30~3.36 and hit the 2nd retracement target (61.8% retracement) after a reversal from Bullish Butterfly harmonic pattern.

See previous analysis of this harmonic pattern:

https://psetrends.blogspot.com/2017/06/rwm-harmonic-pattern-update.html

Trading Plan

- Take some profit and profit run the rest of the position using trailing-stop.

RWM filled the previous gap at 3.30~3.36 and hit the 2nd retracement target (61.8% retracement) after a reversal from Bullish Butterfly harmonic pattern.

See previous analysis of this harmonic pattern:

https://psetrends.blogspot.com/2017/06/rwm-harmonic-pattern-update.html

Trading Plan

- Take some profit and profit run the rest of the position using trailing-stop.

Tuesday, June 13, 2017

RWM harmonic pattern update

Travellers International Hotel Group, Inc.

RWM has potentially completed the Bullish Butterfly harmonic pattern with PRZ around 2.95 (2.88~2.99 range).

See previous analysis of this harmonic pattern for more reference:

https://psetrends.blogspot.com/2017/06/rwm-potential-harmonic-pattern.html

Trading Plan

- Test buy or wait for reversal pattern confirmation around the PRZ area.

- Set stop-loss a few points from recent swing-low.

RWM has potentially completed the Bullish Butterfly harmonic pattern with PRZ around 2.95 (2.88~2.99 range).

See previous analysis of this harmonic pattern for more reference:

https://psetrends.blogspot.com/2017/06/rwm-potential-harmonic-pattern.html

Trading Plan

- Test buy or wait for reversal pattern confirmation around the PRZ area.

- Set stop-loss a few points from recent swing-low.

PHEN harmonic pattern update 2

PHINMA Energy Corporation

PHEN technically completed the Bullish Shark harmonic pattern and fully tested the 2nd PRZ (Potential Reversal Zone) area around 113% retracement. A Bullish Engulfing pattern also formed up around the PRZ area - a potential trend reversal candlestick pattern.

See previous analysis of this harmonic pattern here:

https://psetrends.blogspot.com/search/label/PHEN

Trading Plan

- Buy as close to the 113% retracement PRZ area.

- Set stop-loss a few points below the recent swing-low.

- Potential TPs are the 38.2% and 61.8% retracements.

PHEN technically completed the Bullish Shark harmonic pattern and fully tested the 2nd PRZ (Potential Reversal Zone) area around 113% retracement. A Bullish Engulfing pattern also formed up around the PRZ area - a potential trend reversal candlestick pattern.

See previous analysis of this harmonic pattern here:

https://psetrends.blogspot.com/search/label/PHEN

Trading Plan

- Buy as close to the 113% retracement PRZ area.

- Set stop-loss a few points below the recent swing-low.

- Potential TPs are the 38.2% and 61.8% retracements.

Wednesday, June 7, 2017

BPI price action analysis

Bank of the Philippine Islands

BPI's recent price action is trading near its immediate resistance area around 107 where it could potentially form a Triple Top pattern.

Trading Plan

- Avoid for now.

- If already in a position, take some profit or scale down position. Profit run the rest of the position with trailing-stop.

BPI's recent price action is trading near its immediate resistance area around 107 where it could potentially form a Triple Top pattern.

Trading Plan

- Avoid for now.

- If already in a position, take some profit or scale down position. Profit run the rest of the position with trailing-stop.

Monday, June 5, 2017

SMPH breakout continuation

SM Prime Holdings, Inc.

SMPH is on a breakout continuation from a Cup-and-Handle pattern. The projected target price of this breakout is around 37/38.

See previous analysis on this C&H pattern breakout for more details:

https://psetrends.blogspot.com/2017/05/smph-on-potential-breakout.html

https://psetrends.blogspot.com/2017/05/smph-price-action-analysis.html

SMPH is on a breakout continuation from a Cup-and-Handle pattern. The projected target price of this breakout is around 37/38.

See previous analysis on this C&H pattern breakout for more details:

https://psetrends.blogspot.com/2017/05/smph-on-potential-breakout.html

https://psetrends.blogspot.com/2017/05/smph-price-action-analysis.html

Sunday, June 4, 2017

BLOOM price action update

Bloomberry Resorts Corporation

BLOOM is back within its 8-month Upward Price Channel consolidation and on a potential breakdown from a Double Top pattern (still requires confirmation). If this breakdown continues to unfold, measured target price is around 8.50.

*Recent pullback which followed after forming a Double Top pattern was also forewarned by a Bearish Divergence pattern on some indicators like CCI.

See previous analysis for reference:

https://psetrends.blogspot.com/2017/04/bloom-price-action-analysis.html

Trading Plan

- Avoid for now.

BLOOM is back within its 8-month Upward Price Channel consolidation and on a potential breakdown from a Double Top pattern (still requires confirmation). If this breakdown continues to unfold, measured target price is around 8.50.

*Recent pullback which followed after forming a Double Top pattern was also forewarned by a Bearish Divergence pattern on some indicators like CCI.

See previous analysis for reference:

https://psetrends.blogspot.com/2017/04/bloom-price-action-analysis.html

Trading Plan

- Avoid for now.

Saturday, June 3, 2017

Stocks with BUY Consensus Forecast

*For stocks listed in the Philippine Stock Exchange

*Updated: June 2, 2017

Source: Financial Times

See previous update for reference:

https://psetrends.blogspot.com/2017/05/stocks-with-buy-consensus-forecast.html

*Updated: June 2, 2017

Source: Financial Times

See previous update for reference:

https://psetrends.blogspot.com/2017/05/stocks-with-buy-consensus-forecast.html

Friday, June 2, 2017

RWM potential harmonic pattern

Travellers International Hotel Group, Inc.

RWM is potentially forming a Bullish Butterfly harmonic pattern with PRZ around 2.95 (2.88~2.99 range).

*Gap at 3.30~3.36 - a potential resistance area (may also be potentially filled in the future).

Trading Plan

- Avoid for now.

- Only trade this setup once the harmonic pattern has been completed (ideally with a reversal pattern around the PRZ).

RWM is potentially forming a Bullish Butterfly harmonic pattern with PRZ around 2.95 (2.88~2.99 range).

*Gap at 3.30~3.36 - a potential resistance area (may also be potentially filled in the future).

Trading Plan

- Avoid for now.

- Only trade this setup once the harmonic pattern has been completed (ideally with a reversal pattern around the PRZ).

APX potential harmonic pattern

Apex Mining Co., Inc.

APX is potentially forming a Bullish Gartley harmonic pattern with PRZ (Potential Reversal Zone) around 1.59 (1.51~1.59 range).

Trading Plan

- Avoid for now.

- Only trade this setup once the harmonic pattern has been completed.

APX is potentially forming a Bullish Gartley harmonic pattern with PRZ (Potential Reversal Zone) around 1.59 (1.51~1.59 range).

Trading Plan

- Avoid for now.

- Only trade this setup once the harmonic pattern has been completed.

Wednesday, May 31, 2017

ALI harmonic pattern update

Ayala Land, Inc.

ALI technically completed the Bearish Gartley harmonic pattern and fully tested the PRZ (Potential Reversal Zone ) around 39.56~40.95.

See previous analysis of this harmonic pattern for reference:

https://psetrends.blogspot.com/2017/05/ali-price-action-update.html

Trading Plan

- As noted in the previous analysis, completing the harmonic pattern is a potential profit taking opportunity. Scale down position or take some profit and profit run the rest of the position using trailing-stop.

ALI technically completed the Bearish Gartley harmonic pattern and fully tested the PRZ (Potential Reversal Zone ) around 39.56~40.95.

See previous analysis of this harmonic pattern for reference:

https://psetrends.blogspot.com/2017/05/ali-price-action-update.html

Trading Plan

- As noted in the previous analysis, completing the harmonic pattern is a potential profit taking opportunity. Scale down position or take some profit and profit run the rest of the position using trailing-stop.

Tuesday, May 30, 2017

MEG hit the recent breakout TP

Megaworld Corporation

MEG has recently hit the measured TP from a bullish Pennant pattern breakout at 4.75.

See previous analysis for reference on recent breakout pattern:

https://psetrends.blogspot.com/2017/04/meg-breakout-update.html

Trading Plan

- Take some profit or scale down position.

- Profit run the rest of the position.

MEG has recently hit the measured TP from a bullish Pennant pattern breakout at 4.75.

See previous analysis for reference on recent breakout pattern:

https://psetrends.blogspot.com/2017/04/meg-breakout-update.html

Trading Plan

- Take some profit or scale down position.

- Profit run the rest of the position.

VLL price action update

Vista Land & Lifescapes, Inc.

VLL has retested the upper end of the projected price target from a Downward Price Channel breakout at 5.50 (projected TP range = 5.40~5.50).

*Immediate resistance zone is also around 5.40~5.50.

See previous analysis for reference:

https://psetrends.blogspot.com/2017/04/vll-price-action-analysis.html

Trading Plan

- Take some profit or scale down position.

- Profit run the rest of the position with trailing-stop.

VLL has retested the upper end of the projected price target from a Downward Price Channel breakout at 5.50 (projected TP range = 5.40~5.50).

*Immediate resistance zone is also around 5.40~5.50.

See previous analysis for reference:

https://psetrends.blogspot.com/2017/04/vll-price-action-analysis.html

Trading Plan

- Take some profit or scale down position.

- Profit run the rest of the position with trailing-stop.

PHEN harmonic pattern update

PHINMA Energy Corporation

PHEN continues to form a Bullish Shark harmonic pattern and potentially completed the first significant retracement of the pattern at 88.60% (the first PRZ or Potential Reversal Zone).

Downside risk remains towards 113% retracement, its second PRZ.

See previous analysis on this harmonic pattern for more details:

https://psetrends.blogspot.com/2017/02/phen-on-potential-shark-harmonic-pattern.html

Trading Plan

- Trade this setup once the harmonic pattern has been completed.

- Observe for reversal patterns around the two PRZ areas for potential trading opportunity.

PHEN continues to form a Bullish Shark harmonic pattern and potentially completed the first significant retracement of the pattern at 88.60% (the first PRZ or Potential Reversal Zone).

Downside risk remains towards 113% retracement, its second PRZ.

See previous analysis on this harmonic pattern for more details:

https://psetrends.blogspot.com/2017/02/phen-on-potential-shark-harmonic-pattern.html

Trading Plan

- Trade this setup once the harmonic pattern has been completed.

- Observe for reversal patterns around the two PRZ areas for potential trading opportunity.

PCOR breakout update

Petron Corporation

PCOR is on breakout continuation after breaking the 11-month downtrend line. Projected target price from this breakout is around 11.80.

See previous analysis for details on prior breakouts:

https://psetrends.blogspot.com/2017/05/pcor-price-action-update.html

PCOR is on breakout continuation after breaking the 11-month downtrend line. Projected target price from this breakout is around 11.80.

See previous analysis for details on prior breakouts:

https://psetrends.blogspot.com/2017/05/pcor-price-action-update.html

AGI breakout update

Alliance Global Group, Inc.

After filling the gap around 14.76~14.98, it resumes the breakout from a Bullish Flag pattern with measured price target around 16.60~17.20.

It also recently hit the lower base of the price target from Triple Bottom breakout around 15.30~15.60 range.

See previous analysis for more details on the above mentioned breakouts:

https://psetrends.blogspot.com/2017/05/agi-on-another-breakout.html

Trading Plan

- See previous analysis for appropriate trading plan.

- If trading the Triple Bottom breakout, take some profit or scale down position and profit run the rest of the position with trailing-stop.

After filling the gap around 14.76~14.98, it resumes the breakout from a Bullish Flag pattern with measured price target around 16.60~17.20.

It also recently hit the lower base of the price target from Triple Bottom breakout around 15.30~15.60 range.

See previous analysis for more details on the above mentioned breakouts:

https://psetrends.blogspot.com/2017/05/agi-on-another-breakout.html

Trading Plan

- See previous analysis for appropriate trading plan.

- If trading the Triple Bottom breakout, take some profit or scale down position and profit run the rest of the position with trailing-stop.

Monday, May 29, 2017

EW hit the initial breakout TP

East West Banking Corporation

EW hit last week the initial target from a Bullish Pennant pattern breakout around 26 (breakout measured TP = 26 ~ 26.85).

See previous analysis for more details on Bullish Pennant pattern breakout:

https://psetrends.blogspot.ae/2017/05/ew-on-potential-breakout.html

Trading Plan

- Take some profit or scale down position.

- Profit run the rest of the position with trailing-stop.

EW hit last week the initial target from a Bullish Pennant pattern breakout around 26 (breakout measured TP = 26 ~ 26.85).

See previous analysis for more details on Bullish Pennant pattern breakout:

https://psetrends.blogspot.ae/2017/05/ew-on-potential-breakout.html

Trading Plan

- Take some profit or scale down position.

- Profit run the rest of the position with trailing-stop.

Tuesday, May 23, 2017

PCOR price action update

Petron Corporation

PCOR has already hit the projected target price around 10.50 from its 9-month downtrend line breakout.

See previous analysis for more details on the breakout patterns:

https://psetrends.blogspot.com/2017/05/pcor-on-breakout.html

Trading Plan

- Take profit or scale down position (should have been done already after hitting the TP)

- Profit run the rest of the position with trailing-stop.

PCOR has already hit the projected target price around 10.50 from its 9-month downtrend line breakout.

See previous analysis for more details on the breakout patterns:

https://psetrends.blogspot.com/2017/05/pcor-on-breakout.html

Trading Plan

- Take profit or scale down position (should have been done already after hitting the TP)

- Profit run the rest of the position with trailing-stop.

PNX - major shareholder selling 25% stake in the company

Phoenix Petroleum Philippines, Inc.

In an official disclosure to the exchange yesterday shows that a major shareholder in PNX sold 25% stake in the company at P12 per share.

PNX close yesterday at 11.38.

In an official disclosure to the exchange yesterday shows that a major shareholder in PNX sold 25% stake in the company at P12 per share.

PNX close yesterday at 11.38.

Monday, May 22, 2017

EW on potential breakout

East West Banking Corporation

EW is on a potential breakout from a Bullish Pennant pattern with measured price target around 26~26.85.

See previous analysis for reference to Pennant pattern prior to breakout:

https://psetrends.blogspot.com/2017/05/ew-price-action-analysis.html

Trading Plan

- Buy the breakout.

- Set stop loss on breakdown from recent swing low.

EW is on a potential breakout from a Bullish Pennant pattern with measured price target around 26~26.85.

See previous analysis for reference to Pennant pattern prior to breakout:

https://psetrends.blogspot.com/2017/05/ew-price-action-analysis.html

Trading Plan

- Buy the breakout.

- Set stop loss on breakdown from recent swing low.

EW price action analysis

East West Banking Corporation

EW is potentially forming a Bullish Pennant pattern, considered a trend continuation pattern on breakout.

Trading Plan

- A potential trading buy on breakout.

EW is potentially forming a Bullish Pennant pattern, considered a trend continuation pattern on breakout.

Trading Plan

- A potential trading buy on breakout.

Saturday, May 20, 2017

Friday, May 19, 2017

MAXS potentially forming a bullish harmonic pattern

Max's Group, Inc.

MAXS is potentially forming a Bullish Bat harmonic pattern with PRZ (Potential Reversal Zone) around 15.45~17.00.

*Recent sell-off on MAXS has something to do with its removal from the MSCI Global Small Cap Index.

Details: https://www.facebook.com/PSEStocks/posts/1036643446465949

Trading Plan

- Trade this setup once the harmonic pattern has been completed.

MAXS is potentially forming a Bullish Bat harmonic pattern with PRZ (Potential Reversal Zone) around 15.45~17.00.

*Recent sell-off on MAXS has something to do with its removal from the MSCI Global Small Cap Index.

Details: https://www.facebook.com/PSEStocks/posts/1036643446465949

Trading Plan

- Trade this setup once the harmonic pattern has been completed.

Wednesday, May 17, 2017

AGI on another breakout

Alliance Global Group, Inc.

AGI recently broke its immediate resistance area around 13.90~14.00 which is also a potential breakout from a Bullish Flag pattern with projected target price around 16.60~17.20.

*The gap it created on recent breakout around 14.76~14.98 is a potential level to be filled in the future (may also act as support area)

Current price action is also now near its previous Double Bottom pattern breakout's measured price target around 15.30~15.60.

See previous analysis for reference on prior breakout and trading plan:

https://psetrends.blogspot.com/2017/05/agi-price-action-update.html

Trading Plan

- Buy near the Flag pattern breakout area and set stop-loss on breakdown from recent swing low. Previous major support area around 13.90~14.00 can also be used as reference for stop-loss on breakdown as it will still potentially give a 1:2 risk/reward ratio (relatively high risk though compared to the recent swing low as reference).

- If still trading the previous Double Bottom breakout or in a position trade, see previous analysis (link above) for appropriate trading plan.

AGI recently broke its immediate resistance area around 13.90~14.00 which is also a potential breakout from a Bullish Flag pattern with projected target price around 16.60~17.20.

*The gap it created on recent breakout around 14.76~14.98 is a potential level to be filled in the future (may also act as support area)

Current price action is also now near its previous Double Bottom pattern breakout's measured price target around 15.30~15.60.

See previous analysis for reference on prior breakout and trading plan:

https://psetrends.blogspot.com/2017/05/agi-price-action-update.html

Trading Plan

- Buy near the Flag pattern breakout area and set stop-loss on breakdown from recent swing low. Previous major support area around 13.90~14.00 can also be used as reference for stop-loss on breakdown as it will still potentially give a 1:2 risk/reward ratio (relatively high risk though compared to the recent swing low as reference).

- If still trading the previous Double Bottom breakout or in a position trade, see previous analysis (link above) for appropriate trading plan.

Tuesday, May 16, 2017

JFC previous harmonic pattern invalidated

Jollibee Foods Corporation

JFC's previous Bearish Butterfly harmonic pattern analysis has been invalidated due to recent breakdown from the immediate support area that happens to be the assumed B-leg of the harmonic pattern.

It is important to follow a trading plan appropriate for this kind of patterns that is still in the process of forming. See previous analysis here:

https://psetrends.blogspot.com/2017/05/jfc-price-action-update.html

https://psetrends.blogspot.com/2017/05/jfc-price-action-analysis.html

JFC's previous Bearish Butterfly harmonic pattern analysis has been invalidated due to recent breakdown from the immediate support area that happens to be the assumed B-leg of the harmonic pattern.

It is important to follow a trading plan appropriate for this kind of patterns that is still in the process of forming. See previous analysis here:

https://psetrends.blogspot.com/2017/05/jfc-price-action-update.html

https://psetrends.blogspot.com/2017/05/jfc-price-action-analysis.html

Sunday, May 14, 2017

URC price action analysis

Universal Robina Corporation

URC's recent sell-off started right after it failed to break the 8-month downtrend line with a toppish price action given by a bearish candlestick pattern (Hanging Man). The confirmation of that bearish candle given the fact that it failed to break a major trend line was a potential hint to take some profit or fold an existing position.

Last Friday, URC's price action kissed the 4-month uptrend line support on huge volume after a 5th day free fall. This extra ordinary volume after a few days of sharp sell-off is a potential sign of panic selling or puking effect which could trigger exhaustion.

*Immediate support area base on price congestion is around 160.

*There are two GAPS to be potentially filled in the future (see chart below).

Trading Plan

- Monitor for possible technical rebound.

- If already in a trading position for this potential exhaustion signal, set appropriate stop-loss.

URC's recent sell-off started right after it failed to break the 8-month downtrend line with a toppish price action given by a bearish candlestick pattern (Hanging Man). The confirmation of that bearish candle given the fact that it failed to break a major trend line was a potential hint to take some profit or fold an existing position.

Last Friday, URC's price action kissed the 4-month uptrend line support on huge volume after a 5th day free fall. This extra ordinary volume after a few days of sharp sell-off is a potential sign of panic selling or puking effect which could trigger exhaustion.

*Immediate support area base on price congestion is around 160.

*There are two GAPS to be potentially filled in the future (see chart below).

Trading Plan

- Monitor for possible technical rebound.

- If already in a trading position for this potential exhaustion signal, set appropriate stop-loss.

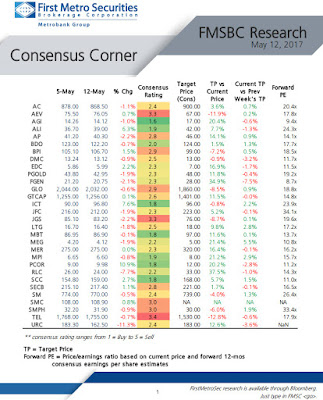

Friday, May 12, 2017

Consensus of stocks under the PSEi index

Source: First Metro Securities

https://www.firstmetrosec.com.ph/

May 12, 2017

(Click on the picture below to enlarge)

https://www.firstmetrosec.com.ph/

May 12, 2017

(Click on the picture below to enlarge)

Thursday, May 11, 2017

DD price action analysis

DoubleDragon Properties Corp.

DD is currently tiptoeing the immediate support area around 51 in a sideways price action.

Trading Plan

- Buy near support for a potential range trading opportunity.

- Set appropriate stop-loss with at least 1:2 risk reward/ratio.

DD is currently tiptoeing the immediate support area around 51 in a sideways price action.

Trading Plan

- Buy near support for a potential range trading opportunity.

- Set appropriate stop-loss with at least 1:2 risk reward/ratio.

Wednesday, May 10, 2017

CEB correction mode

Cebu Air, Inc.

CEB is now in a sharp correction after recently hitting the Double Bottom price target at 110. For now, the major support around 100 remains intact after CEB close today at 110.1 from an intraday low of 98.20.

If previously holding CEB and trading the Double Bottom pattern, it is assumed that appropriate profit taking action has been carried out already. See previous analysis for more details: https://psetrends.blogspot.com/2017/04/ceb-price-action-update.html

Always "plan your trade and trade your plan"...

Trading Plan

- Avoid for now until another high probability trading setup comes along.

CEB is now in a sharp correction after recently hitting the Double Bottom price target at 110. For now, the major support around 100 remains intact after CEB close today at 110.1 from an intraday low of 98.20.

If previously holding CEB and trading the Double Bottom pattern, it is assumed that appropriate profit taking action has been carried out already. See previous analysis for more details: https://psetrends.blogspot.com/2017/04/ceb-price-action-update.html

Always "plan your trade and trade your plan"...

Trading Plan

- Avoid for now until another high probability trading setup comes along.

JFC price action update

Jollibee Foods Corporation

JFC fails to break the immediate resistance around 220 and formed up a Shooting Star candlestick pattern (bearish). The confirmation candle today also transforms the bearish candlestick pattern to an Evening Star pattern, considered a reversal pattern.

*Immediate support area is around 210~212.

*If immediate support area fails to hold, the Bearish Butterfly harmonic pattern will like be invalidated.

See the previous analysis of this bearish candlestick pattern and harmonic pattern including appropriate trading plan:

https://psetrends.blogspot.com/2017/05/jfc-price-action-analysis.html

JFC fails to break the immediate resistance around 220 and formed up a Shooting Star candlestick pattern (bearish). The confirmation candle today also transforms the bearish candlestick pattern to an Evening Star pattern, considered a reversal pattern.

*Immediate support area is around 210~212.

*If immediate support area fails to hold, the Bearish Butterfly harmonic pattern will like be invalidated.

See the previous analysis of this bearish candlestick pattern and harmonic pattern including appropriate trading plan:

https://psetrends.blogspot.com/2017/05/jfc-price-action-analysis.html

BRN price action analysis

A Brown Company, Inc.

Potential confirmation today from a Bearish Counter Attack candlestick pattern that formed around the resistance area.

*Immediate resistance to break at close = 1.30.

*Next resistance at 1.37~1.38.

It also technically completed the Bearish AB=CD harmonic pattern. The PRZ area (Potential Reversal Zone) is a potential profit taking area.

Potential confirmation today from a Bearish Counter Attack candlestick pattern that formed around the resistance area.

*Immediate resistance to break at close = 1.30.

*Next resistance at 1.37~1.38.

It also technically completed the Bearish AB=CD harmonic pattern. The PRZ area (Potential Reversal Zone) is a potential profit taking area.

JFC price action analysis

Jollibee Foods Corporation

JFC is potentially forming a Bearish Butterfly harmonic pattern with PRZ (Potential Reversal Zone) around 229.80 (228.80~231.50 range). In the short term, it will need to break the immediate resistance around 220 to give it higher probability of completing the harmonic pattern.

The price action yesterday fails to break at close the immediate resistance at 220 and potentially formed up a Shooting Star candlestick pattern (considered a trend reversal pattern on confirmation).

Trading Plan

- Avoid for now if you are not in a trade yet.

- The PRZ area is a potential profit taking zone.

JFC is potentially forming a Bearish Butterfly harmonic pattern with PRZ (Potential Reversal Zone) around 229.80 (228.80~231.50 range). In the short term, it will need to break the immediate resistance around 220 to give it higher probability of completing the harmonic pattern.

The price action yesterday fails to break at close the immediate resistance at 220 and potentially formed up a Shooting Star candlestick pattern (considered a trend reversal pattern on confirmation).

Trading Plan

- Avoid for now if you are not in a trade yet.

- The PRZ area is a potential profit taking zone.

Tuesday, May 9, 2017

ALI price action update

Ayala Land, Inc.

ALI is potentially forming a Bearish Gartley harmonic pattern with a PRZ (Potential Reversal Zone) around 39.56 (39.56~40.95 range). The recent breakout from its immediate resistance area around the B leg gives it a higher probability of completing the harmonic pattern.

Trading Plan

- Avoid for now if you are not it a trade yet.

- The PRZ area is a potential profit taking zone.

ALI is potentially forming a Bearish Gartley harmonic pattern with a PRZ (Potential Reversal Zone) around 39.56 (39.56~40.95 range). The recent breakout from its immediate resistance area around the B leg gives it a higher probability of completing the harmonic pattern.

Trading Plan

- Avoid for now if you are not it a trade yet.

- The PRZ area is a potential profit taking zone.

Monday, May 8, 2017

PCOR on a breakout

Petron Corporation

PCOR is on a breakout from an Ascending Triangle pattern with a measured price target around 10.00.

It's also on a breakout from its 9-month Downtrend Line with a projected price TP around 10.50.

Trading Plan

- Buy near the breakout area.

- Set stop-loss on breakdown from recent swing-low (like a few points below 8.95).

PCOR is on a breakout from an Ascending Triangle pattern with a measured price target around 10.00.

It's also on a breakout from its 9-month Downtrend Line with a projected price TP around 10.50.

Trading Plan

- Buy near the breakout area.

- Set stop-loss on breakdown from recent swing-low (like a few points below 8.95).

Sunday, May 7, 2017

MRSGI Triangle Consolidation

Metro Retail Stores Group, Inc.

MRSGI is potentially consolidating in a Descending Triangle pattern, considered a bearish and trend continuation pattern on support breakdown.

*Immediate support area is around 3.51~3.56.

Trading Plan

- Avoid for now and monitor how the triangle pattern unfolds.

MRSGI is potentially consolidating in a Descending Triangle pattern, considered a bearish and trend continuation pattern on support breakdown.

*Immediate support area is around 3.51~3.56.

Trading Plan

- Avoid for now and monitor how the triangle pattern unfolds.

Saturday, May 6, 2017

2GO potentially toppish

2GO Group, Inc.

2GO is potentially forming a toppish/reversal pattern with a Shooting Star candlestick pattern (requires confirmation). This reversal pattern is in confluence with the PRZ (Potential Reversal Zone) of a Bearish AB=CD harmonic pattern.

Trading Plan

- Avoid for now and monitor for a confirmation of the reversal pattern.

- If previously trading the rally, scale down position or take some profit on confirmation of the bearish candlestick pattern. Profit run the rest of the position with trailing-stop.

2GO is potentially forming a toppish/reversal pattern with a Shooting Star candlestick pattern (requires confirmation). This reversal pattern is in confluence with the PRZ (Potential Reversal Zone) of a Bearish AB=CD harmonic pattern.

Trading Plan

- Avoid for now and monitor for a confirmation of the reversal pattern.

- If previously trading the rally, scale down position or take some profit on confirmation of the bearish candlestick pattern. Profit run the rest of the position with trailing-stop.

SMPH on potential breakout

SM Prime Holdings, Inc.

SMPH is on a potential breakout from a Cup-and-Handle pattern that formed up for over 10 months. The projected target price of this breakout is around 37/38.

It also recently hit the projected target price from a Downward Price Channel breakout around 31.4~31.5. See previous analysis for potential action when trading this pattern.

*Immediate support areas are around 31.4~31.5 and 31.

See previous analysis for additional information including trading plan:

https://psetrends.blogspot.com/2017/05/smph-price-action-analysis.html

SMPH is on a potential breakout from a Cup-and-Handle pattern that formed up for over 10 months. The projected target price of this breakout is around 37/38.

It also recently hit the projected target price from a Downward Price Channel breakout around 31.4~31.5. See previous analysis for potential action when trading this pattern.

*Immediate support areas are around 31.4~31.5 and 31.

See previous analysis for additional information including trading plan:

https://psetrends.blogspot.com/2017/05/smph-price-action-analysis.html

Friday, May 5, 2017

SMPH price action analysis

SM Prime Holdings, Inc.

SMPH's recent breakout from a Downward Price Channel consolidation has already hit the base of the projected target price around 31.4~31.5.

*Immediate resistance is also around 31.4~31.5.

On the bigger time frame, SMPH is potentially forming a bullish Cup-and-Handle pattern where a breakout could also potentially send the price towards 37.

Trading Plan

- Scale down position or take some profit if trading the Downward Price Channel breakout. Profit run the rest with appropriate trailing stop.

- Monitor the Cup-and-Handle pattern for a potential position trade.

SMPH's recent breakout from a Downward Price Channel consolidation has already hit the base of the projected target price around 31.4~31.5.

*Immediate resistance is also around 31.4~31.5.

On the bigger time frame, SMPH is potentially forming a bullish Cup-and-Handle pattern where a breakout could also potentially send the price towards 37.

Trading Plan

- Scale down position or take some profit if trading the Downward Price Channel breakout. Profit run the rest with appropriate trailing stop.

- Monitor the Cup-and-Handle pattern for a potential position trade.

Thursday, May 4, 2017

FLI breakout

Filinvest Land, Inc.

FLI is on a breakout from its 11-month downtrend line with a projected target price around 1.85~1.90.

*Immediate resistance area is around 1.80~1.82.

Trading Plan

- Buy the breakout (closer to the breakout area the better).

- Set a stop-loss just a few points below the breakout area.

FLI is on a breakout from its 11-month downtrend line with a projected target price around 1.85~1.90.

*Immediate resistance area is around 1.80~1.82.

Trading Plan

- Buy the breakout (closer to the breakout area the better).

- Set a stop-loss just a few points below the breakout area.

Wednesday, May 3, 2017

NOW breakdown update

NOW Corporation

NOW is on a breakdown continuation and hit the initial price target of an Upward Price Channel breakdown around 2.80.

Trading Plan

- Avoid for now.

NOW is on a breakdown continuation and hit the initial price target of an Upward Price Channel breakdown around 2.80.

Trading Plan

- Avoid for now.

TUGS range bound price action continues

Harbor Star Shipping Services, Inc.

TUGS continue its range bound price action with immediate support area around 3.15~3.24 and immediate resistance around.

See previous TUGS analysis for reference including trading plan:

https://psetrends.blogspot.com/2017/04/tugs-on-range-bound-price-action.html

TUGS continue its range bound price action with immediate support area around 3.15~3.24 and immediate resistance around.

See previous TUGS analysis for reference including trading plan:

https://psetrends.blogspot.com/2017/04/tugs-on-range-bound-price-action.html

AGI price action update

Alliance Global Group, Inc.

AGI fails to break the immediate resistance area at 14.80~15.00 and currently, in a pullback mode.

The previous major resistance prior to breakout from Triple Bottom pattern has now becomes the major support area - around 13.90~14.00.

*The Triple Bottom pattern breakout remains valid with a projected target price around 15.30~15.60.

See previous AGI analysis related to this Triple Bottom breakout (was mistakenly mentioned Double Bottom before):

https://psetrends.blogspot.com/search/label/AGI

Trading Plan

- If previously trading the Triple Bottom breakout, set a stop-loss on major support breakdown (13.90~14.00).

- If in a position trade as recommended by previous AGI article during consolidation, take profit if trailing-stop on remaining position was hit.

AGI fails to break the immediate resistance area at 14.80~15.00 and currently, in a pullback mode.

The previous major resistance prior to breakout from Triple Bottom pattern has now becomes the major support area - around 13.90~14.00.

*The Triple Bottom pattern breakout remains valid with a projected target price around 15.30~15.60.

See previous AGI analysis related to this Triple Bottom breakout (was mistakenly mentioned Double Bottom before):

https://psetrends.blogspot.com/search/label/AGI

Trading Plan

- If previously trading the Triple Bottom breakout, set a stop-loss on major support breakdown (13.90~14.00).

- If in a position trade as recommended by previous AGI article during consolidation, take profit if trailing-stop on remaining position was hit.

Tuesday, May 2, 2017

GTCAP back for another crack at trendline resistance

GT Capital Holdings, Inc.

GTCAP retested the over 8-month downtrend resistance line but with another bearish candlestick pattern potentially forming again - a Hanging Man candle (requires confirmation).

*It also retested the immediate resistance at 1275.

*Failure to break both resistances followed by another correction will likely form up another Double Top pattern (bearish).

On the other hand, a breakout from the downtrend line will likely have an initial price target around 1360.

See previous GTCAP analysis related to this downtrend line:

https://psetrends.blogspot.com/2017/04/gtcap-failure-to-break-downtrend-line.html

Trading Plan

- Avoid for now and monitor the price action along the downtrend line and the immediate resistance.

- Buy on breakout confirmation.

GTCAP retested the over 8-month downtrend resistance line but with another bearish candlestick pattern potentially forming again - a Hanging Man candle (requires confirmation).

*It also retested the immediate resistance at 1275.

*Failure to break both resistances followed by another correction will likely form up another Double Top pattern (bearish).

On the other hand, a breakout from the downtrend line will likely have an initial price target around 1360.

See previous GTCAP analysis related to this downtrend line:

https://psetrends.blogspot.com/2017/04/gtcap-failure-to-break-downtrend-line.html

Trading Plan

- Avoid for now and monitor the price action along the downtrend line and the immediate resistance.

- Buy on breakout confirmation.

Subscribe to:

Posts (Atom)